In changing markets and economic uncertainty, a 100 grams gold bar is a reliable choice for securing wealth. It is an investment with a long history of value. Knowing the gold bar price is key for investors and those looking for stability.

Gold acts as a shield against wealth loss. It keeps part of your investments safe from other investments’ ups and downs. We will reveal important details about the 100 grams gold bar market price, which will help you make choices for your financial health.

Understanding The Value Of 100 Grams Gold Bars

The value of gold bars, weighing 100 grams, comes from real and seen qualities. Their shiny look and potential to grow in value make them appealing. Let’s dive into these metals’ investment and long-term value as a strong option for portfolio diversity.

Gold is a safe spot during economic troubles, fighting inflation and currency drops. The worth of 100 grams of gold bars helps in wealth preservation. Unlike paper money, gold keeps its buying power, boosting its long-term value.

- The value of gold bars is quite stable, showing less ups and downs than stocks or bonds.

- Including gold bars in your portfolio can reduce risk in bad market times, leading to a well-rounded asset mix.

- Gold is known worldwide as a currency, giving 100 grams of gold bars a global investment appeal.

For smart investors looking to grow wealth, buying 100-gram gold bars is a wise decision. Their value isn’t just about spreading investment risks; it’s about owning a timeless asset. The constant demand for gold adds to the long-term value of these bars, ensuring that today’s investment can yield benefits for the future.

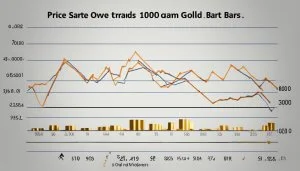

Current Trends In 100 Grams Gold Bar Price

The world of precious metal investments changes a lot. Gold bar price trends, market trends, and price fluctuations are crucial for investors. Knowing these changes helps you make smart choices.

Factors Influencing The Gold Spot Price

Different factors from around the world affect gold bar price trends. Let’s talk about the main ones:

- Supply and Demand: This basic rule can raise prices. When many want gold but there’s not much available, it becomes pricier.

- Market Conditions: Economic issues or big world events can make people buy more gold. It’s seen as a safe choice.

- Economic Indicators: Interest rates, the cost of living, and the dollar’s strength can affect gold prices.

Calculating The Price With Current Gold Rates

When figuring out the cost of a 100 grams gold bar, it’s important to understand price fluctuations. Investors should think about:

- The current price of gold by the ounce, and then converting that to the bar’s weight.

- Extra fees from dealers, which cover making the bar, the brand, and their profit.

- Keeping an eye on market trends helps guess future price changes. This helps in deciding when to buy or sell.

Staying updated with the gold market helps investors make wise choices about buying 100 grams gold bars.

The Esteemed Manufacturers Of Gold Bars

Exploring the precious metals world means getting to know gold bar manufacturers well-loved for their high standards. Reputable brands have built a name for making top-quality gold bars. This is important not just for the quality but also for knowing you can resell them confidently. Brands like PAMP Suisse have set the bar high, becoming examples for other trusted manufacturers.

PAMP Suisse is a top name in the game. This Swiss company is known for high-quality gold bars, honouring Switzerland’s reputation in watchmaking and banking. Their gold bars come with Veriscan® technology, ensuring authenticity and boosting buyer confidence.

Valcambi, another Swiss brand, has over 50 years of excellence in refining. The Royal Canadian Mint is also a standout, marrying precision with artistic designs. Their products win the hearts of collectors and investors, making these names not just industry participants but foundational pillars.

- PAMP Suisse – known for its craftsmanship and security features.

- Valcambi – respected for its historical excellence in refining.

- Royal Canadian Mint – blends precision with beautifully designed products.

Investing in gold bars from these reputable brands isn’t just about getting a physical asset. Knowing your investment comes from the most trusted manufacturers means peace of mind. In a market where trust is as crucial as the metal itself, these brands provide the reliability every investor looks for.

Why A 100 Grams Gold Bar Is An Attractive Investment

A 100-gram gold bar offers key advantages, making it a wise choice for smart financial planning. Its value is not just in its physical beauty. It also lies in the benefits of investing in gold, such as diversifying your portfolio and preserving wealth.

Through history, gold’s stability has shown it to be a safe place in shaky economic times. This has built a strong trust in gold for keeping value safe. Let’s look at why a small 100 grams gold bar can be a big part of your investment plan.

Gold’s Performance Against Inflation

A top benefit of gold is its resistance to inflation. While paper money can lose value, gold often keeps its value or grows, helping investors maintain their buying power over time.

Gold’s Historical Stability During Economic Downturns

Another reason to invest in gold is its steady value in tough economic times. While stocks and bonds might drop, gold’s price often increases when other assets lose trust. Owning a 100 grams gold bar offers a solid asset that can face unstable markets well.

- Globally recognized value

- Hedge against currency devaluation

- Liquidity and ease of sale

Indeed, choosing gold as an investment leads to possible security and growth, even when other investments might struggle. Holding a 100 grams gold bar is wise for those aiming for stability and lasting value.

The Process Of Buying 100 Grams Gold Bars

It’s thrilling to enter the realm of precious metals by buying gold bars. It’s about getting a timeless asset. Knowing how to buy ensures your investment meets your goals. Before diving in, look at key points in choosing gold bars.

Choosing Between Cast And Minted Bars

It’s vital to pick the right gold bar. Cast and minted bars suit different tastes.

- Cast Gold Bars: These bars have a unique, rugged look. They’re made by pouring melted gold into molds, and their rustic charm appeals to many.

- Minted Gold Bars: Known for their sleek design, these bars are crafted precisely. If you love a perfect finish, these are for you.

Understanding Purity And Certifications

A gold bar’s value lies in its beauty, purity, and certifications. Let’s talk about what makes a bar top-notch.

- Purity: Aim for 999.9 fineness. This means the gold is 99.99% pure. High purity equals more value for your investment.

- Certifications: Trustworthy dealers offer a certificate. The certificate proves the bar’s weight, purity, and a unique number and secures your purchase.

Considering the right bar type and purity is key when buying gold bars. Understanding these aspects helps investors make smart choices. This clarity aligns their buying strategy with their financial goals.

Storing Your Gold Bars Safely And Securely

Buying gold bars is a solid way to protect your investment and add variety to your portfolio. However, you must consider gold bar storage options for safety and security. Picking the right storage method is key to avoiding losing your investment to theft or misplacement.

Finding a safe place to keep your gold isn’t hard once you know the secure storage options. These options are made to protect your gold and give you peace of mind. Here are ways to keep your gold safe and sound:

- A home safe is handy but needs professional installation and to be hidden well. Choose safes that have the best security.

- Bank safety deposit boxes offer great security away from home.

- Private vault services are experts in gold bar storage and provide insurance and climate control.

To make your gold bars even safer, think about these tips:

- Use storage places with strong security, like 24/7 watch and armed protection.

- Pick services that insure your gold against loss.

- Keep a detailed list of your gold, with serial numbers and certificates, away from where you store them.

Protecting your investment needs continuous effort. Always check the security of your storage and keep up with new ways to protect your gold. The main aim is to keep your gold safe and valuable for the future.

Options For Reselling Your 100 Grams Gold Bar

Selling gold bars is easy if you know the resale market and buyback policies. This knowledge helps whether you are new or experienced in gold investments. It prepares you to sell your assets well.

Navigating The Resale Market

The market for selling gold bars is big. It includes local shops and online sites. Remember, each place offers different conditions and prices.

Consider these tips:

- Research current gold prices to set realistic expectations for the offers you might receive.

- Seek out reputable dealers or auction houses with positive reviews and a history of fair transactions.

- Compare offers from multiple buyers to ensure you get a competitive rate for your 100 grams gold bar.

Evaluating The Buyback Policies Of Dealers

Before selling your gold, examine the dealer’s buyback policy closely. The right policy makes selling smooth and worthwhile. Make sure to check:

- This is confirmation of the dealer’s willingness to buy back gold bars, regardless of whether you originally purchased them from them.

- Understand any fees or commissions that may affect your take-home amount.

- Clarity on the timeframe for payment after the sale has been agreed upon and completed.

Selling your gold bars can help you achieve your financial goals. Stay informed and choose wisely for a successful sale.

Diversification Benefits Of 100 Grams Gold Bars In Investment Portfolios

Investors are always searching for ways to improve their allocation of assets and risk management. Gold bars weighing 100 grams have become popular for diversifying investment portfolios. Seen as a safe option during market unrest, they offer protection against inflation and changes in currency value.

It’s crucial to understand how diversification in investment portfolios works. A diversified portfolio can lower volatility and reduce the chance of big losses. Because of their inherent value, Gold bars have a special role in this. They usually don’t follow the same trends as stocks and bonds.

- Gold’s value can help improve a portfolio’s performance, even when other assets don’t do well.

- Gold bars can protect against systemic risks, as financial market issues don’t impact gold.

- The physical form of 100 grams gold bars gives investors comfort, reminding them of their wealth outside digital spaces.

The importance of portfolio allocation is immense. A well-balanced portfolio is key to successful long-term investments. With their constant value, gold bars remind us of precious metals’ power to safeguard wealth.

In risk management, adding gold to a portfolio helps diversify and lower risks from market downturns. Gold’s steady demand as a global currency standard shows its role in stabilising investment portfolios.

- It’s important to decide how much gold to have compared to other assets for the best risk-adjusted returns.

- Regularly checking and adjusting the portfolio keeps the gold investment in line with the investor’s risk comfort and financial goals.

In summary, including 100-gram gold bars in investment portfolios provides depth, enriches risk management strategies, and lays a strong wealth accumulation foundation. Gold’s proven resilience and diversification benefits make it a vital asset for investors, who can then confidently face complex market cycles.

Conclusion

Investing in a gold bar is more than just owning a shiny object. It’s a smart step for long-term financial safety and growing wealth. Gold bars, like the 100 grams gold bar, are valuable, easy to trade and protect against market drops and rising costs. They represent not just historical desire but also a real way to secure wealth for the future.

Trusted brands like PAMP Suisse ensure the quality of these investments. Supply and demand drive the changing prices of gold bars. This knowledge helps investors make smart choices in buying, keeping, and selling these metals, allowing them to meet their financial goals over time.

Adding gold bars to your investment mix highlights the importance of diversification. This strategy helps balance risks and stabilize your assets. Whether you’re experienced or new to investing, adding a 100 grams gold bar to your collection can diversify your portfolio. Leading your wealth with gold investments might be the best decision in uncertain financial times.

FAQ

What Factors Influence The Price Of 100 Grams Of Gold Bars?

The price of 100-gram gold bars changes due to supply and demand. Market conditions and economic factors also play a big part in influencing the gold spot price.

How Do I Calculate The Price Of A 100 Grams Gold Bar?

To determine the price of a 100-gram gold bar, use current gold rates. Simply multiply the bar’s weight by the current price per gram.

Who Are Some Reputable Manufacturers Of Gold Bars?

PAMP Suisse is renowned for creating high-quality gold bars. They are among the top manufacturers.

Why Should I Consider Investing In A 100 Grams Gold Bar?

Gold bars, like the 100 grams, offer protection against inflation. They tend to hold their value in tough economic times. This makes them a smart addition to your investment mix.

What Should I Consider When Buying 100 Grams Gold Bars?

When buying 100-gram gold bars, consider whether you want cast or minted bars. Also, check the purity levels. Look for certifications. These ensure you’re buying quality bars.

How Should I Store My 100 Grams Gold Bars?

Storing your 100 grams gold bars safely is key. There are many secure storage options. Choosing the right one will safeguard your investment.

How Can I Resell My 100 Grams Gold Bar?

If you plan to resell your 100 grams gold bar, look into the resale market. Checking dealers’ buyback policies will help you secure the best price.

How Can 100 Grams Gold Bars Benefit My Investment Portfolio?

Adding 100-gram gold bars to your portfolio is wise. They help spread out risk, which can improve your portfolio’s overall performance.