Creating a trading plan that is ready for evaluation by professional trading environments requires structure, discipline, and precision. While many traders rely on intuition or scattered strategies, a strong trading plan based on the powerful features of MetaTrader 5 (MT5) can significantly increase your chances of success. In this article, we’ll walk through the key elements of building an evaluation-ready trading plan using MetaTrader 5 indicators, covering everything from market analysis to risk management.

1. Clearly Define Your Trading Goals

Clarity is the precursor to any plan that is ready for evaluation. You have to set your goal of money, your risk tolerance, your preferred trading style (scalping, swing trading, intraday, etc.), and measurement of performance. These are the factors that direct your plan framework to ensure your usage of indicators has a purpose. For instance, a long-term consistency-based trader will use slower trend-based indicators, whereas a scalper will use quicker oscillators.

2. Select a Trading Strategy and Time Interval

Having your goals, the subsequent selection is the picking of a strategy and interval. MT5 is versatile by means of time frames—M1 to month charts—hence suited for any trading type. Your strategy should be suited for your lifestyle and trading routine. In an investigation, H1 or daily intervals are commonly used due to the trade-off between signal rate and noise elimination. Choose what you will trade, breakouts, pullbacks, trend continuations, or reversals, and base your indicator choices around that.

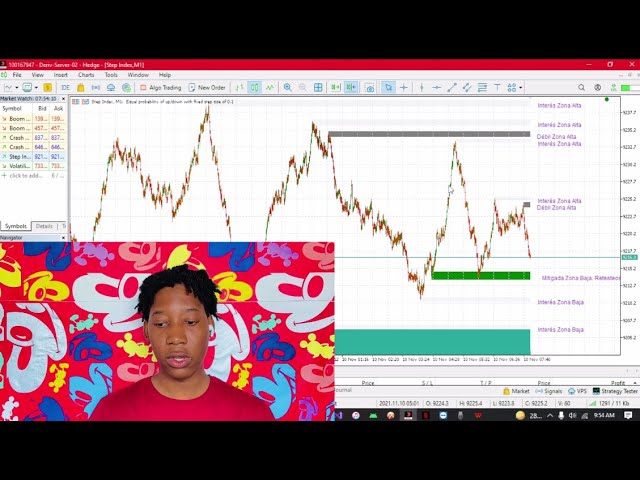

3. Utilize Trend Indicators for Direction of the Market

Deciding on the direction of the market is crucial, particularly when trading under rule of assessment where losses are scrupulously tracked. Trend-following symbols such as the Moving Average (MA), Average Directional Index (ADX), and Parabolic SAR are effective signals in MT5. For example, a 50-period Moving Average can act as a filter—purchasing if the market is above the average and selling if below. ADX assists with gauging strength of trend to avoid trading in flat markets.

4. Add Momentum Indicators for Entry Signals

With direction bias established, you will want good entry signals. Momentum indicators like the Relative Strength Index (RSI), MACD, and Stochastic Oscillator are all excellent on MT5. For instance, RSI can validate overbought or oversold states consistent with your trend analysis. By using RSI and MACD crossovers, you can cancel false entries and receive confirmation that is in your direction, high-probability setups.

5. Use Volume Indicators to Validate Trades

Volume tends to be an overlooked indicator, but it is a defining characteristic of institutional-scale trading. MT5 comes with indicators such as On-Balance Volume (OBV) and Volumes that let you know if price action is accompanied by market participation. In terms of analysis, such indicators can be used to verify breakouts or identify traps. For instance, if price breaks a significant level without confirming volume, you can steer clear of a false breakout that could cause drawdown.

6. Clearly Define Entry and Exit Rules

An evaluation-ready plan requires precision—not only analysis but also follow-through. By your selected indicators, establish clear entry and exit points for trades. For example: “Enter long if price is above the 50-MA, RSI crosses level 50 from below, and MACD indicates a bullish crossover.” Likewise, establish exit points as: “Exit on a 1:2 risk-reward basis or when RSI re-enters the middle zone.” This reduces guesswork and enhances consistency under pressure.

7. Apply Risk Management Indicators to Preserve Capital

Most testing will come with stringent drawdown rules. Capital protection must be your strategy’s central theme. MT5 provides features such as the ATR (Average True Range), wherein you can dynamically reallocate stop-loss in relation to prevailing volatility. For example, you can employ a stop of 1.5 ATR to provide your trade with sufficient room without exposing it too much. Then, utilize position size calculators or scripts so that your lot size will prove to be within testing parameters.

8. Monitor Performance Using MT5’s Built-in Tools

Monitoring performance will be a part of any effective trading plan. MT5 provides comprehensive trade history, strategy tester reports, and journal logs. Using these features, you can monitor trends, mistakes, and areas where you can be improved. Monitoring your trades from time to time and checking such statistics as win rate, risk-to-reward ratio, and expectancy will indicate whether your plan is due for an update—or if it requires a change.

9. Practice Your Plan in a Demo Environment First

Test your plan on a demo account before you use it in a high-stress setting. MT5 gives you the ability to simulate real market conditions using your full indicator configuration. You can narrow down entry/exit criteria and see psychological weakness without risking capital. A successful month of demo trading with solid results gives you a confidence boost and ensures that your strategy has what it takes to perform under pressure.

10. Stay Disciplined and Don’t Overdo Indicators

Finally, discipline is the link between planning and execution. Stick to your plan even in losing spells or volatile markets. Don’t keep making changes to indicators or trying to overload your charts with too many gadgets. A minimalist configuration of 3–4 well-selected MT5 indicators can usually outperform a busy screen with confusing signals. Keep in mind: simplicity begets consistency.

Conclusion

Building an eval-ready trading plan with MetaTrader 5 indicators is a question of form, accuracy, and discipline. By melding trend analysis, momentum signals, volume confirmation, and risk management—all in the robust MT5 platform—you set the stage for professional success. Whether you’re looking for a career in prop firm or simply wish to trade on a higher level, using MT5 indicators correctly can turn your strategy into a repeatable, scalable trading system.